The market has rallied after investors panic sold in early April in a classic stock market move of shaking weak investors out of their positions. But as with any downtrend, there can be only so much selling. Once those fretful investors have sold, only confident buyers remain and the market rallies.

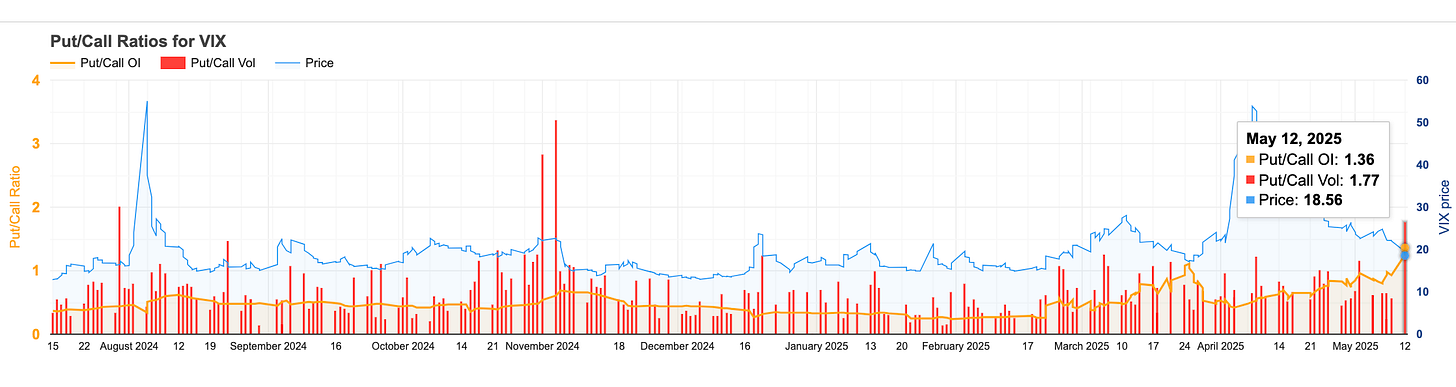

After today’s pop, $SPX has now rallied 17% while SOXX 0.00%↑ has rallied 31% while VIX haas come down from 60 to below 20.

Of notable interest, today VIX P/C Open Interest clocked in at 1.36 — an elevated level that signals strong put positioning, while today’s P/C trade volume hit 1.7

Is This Excessive Bullishness Nearing a Top?

With the VIX Put/Call Open Interest ratio at 1.36, we’re seeing the highest level of demand for VIX puts relative to calls in years.

This is not common. On the surface, this might seem bearish for volatility—but zooming out, it often signals excessive complacency in the equity market.

It suggests:

Heavy demand for VIX downside exposure (betting volatility will fall).

A market that's confident in continued calm, possibly overconfident.

Potential over-hedging unwinding or speculative short-vol trades.

Interpreting the Signal

This isn’t a crash indicator. But it does suggest that hedging has been fiercely unwound and vix put buyers are taking advantage of the sub-20 VIX print. Doomer bears who doubted the tariff play have been trounced and have capitulated.

But First: A Bit More Room to Rally?

Despite the signal from the volatility markets, the equity market may still have a bit more room to climb—at least in the near term. Here's why:

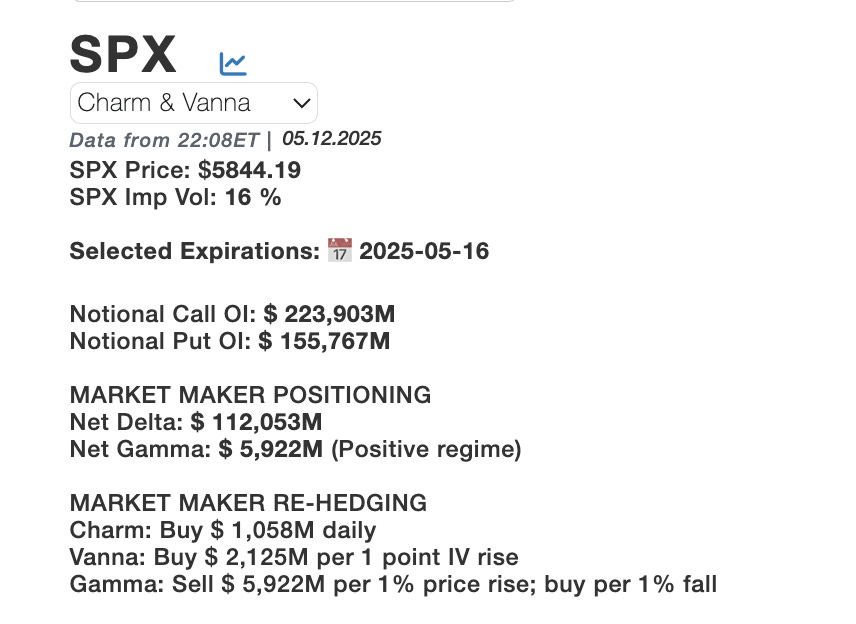

Charm flows (delta decay in existing long options) remain modestly positive through this week. That generally supports market strength as dealers buy to maintain delta hedges.

Vanna flows (delta changes as implied volatility moves) are mildly supportive with buying occurring should IV rises.

Together, these dealer-driven flows may support a slow grind higher into May OPEX (May 17), especially in the absence of macro catalysts.

May OPEX: Light Open Interest, But Heavy 6,000 Strikes

May OPEX has relatively low total open interest, nearly half that of June OPEX, meaning fewer structural flows to anchor price.

Yet both May and June show large positioning at the 6,000 strike on SPX/SPXW/SPY equivalents.

This congestion near 6,000 likely creates a gravitational pull—but also a ceiling. If we rally into that zone, price may stall or mean-revert as call walls play a more active role.

Keep reading with a 7-day free trial

Subscribe to Trend & Trigger, by Trading Volatility to keep reading this post and get 7 days of free access to the full post archives.